Eco-friendly technologies are no longer a luxury. They’re a necessity amidst a more volatile energy market and tightening climate regulations. Solar energy, once seen as subsidy-driven experiments, has matured into mainstream investments delivering dual dividends: measurable environmental impact and long-term financial returns. For businesses and policymakers across Asia, the rise of green tech signals more than just an environmental shift; it marks a strategic and economic transformation.

This article explores three dimensions of solar energy’s growing role in Asia: its environmental impact, its financial and investment returns, and its strategic value in advancing sustainability goals.

Environmental Impact: Clear Gains, Lower Emissions

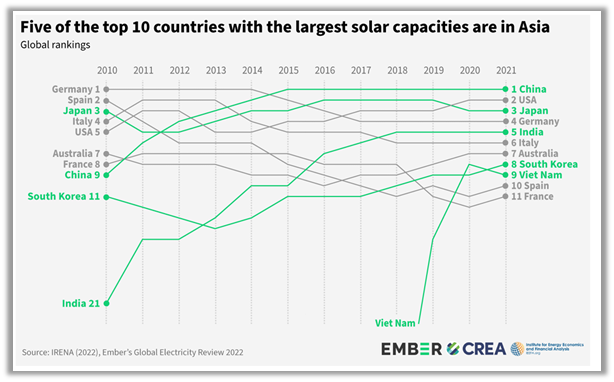

Asia’s renewable energy is expanding rapidly, and solar energy is leading the charge.

A 2022 study by Ember, CREA, and IEEFA revealed that seven countries - China, India, Japan, South Korea, Vietnam, the Philippines, and Thailand - collectively avoided USD 34 billion in fossil fuel costs in just six months. That’s 9% of their total fossil fuel spending during that period.

Source: https://ieefa.org/resources/sunny-side-asia

Momentum has only accelerated. In 2024, Asia added 450,000 MW of renewable capacity – outpacing Europe by more than fourfold and North America by nearly fivefold. This surge cements Asia’s leadership in global clean-energy deployment.

Innovation is amplifying these gains. Floating solar projects, like Indonesia’s 192 MW Cirata Dam and Thailand’s Sirindhorn Dam hybrid system, are redefining what’s possible. These projects pair solar with hydropower, reduce evaporation, preserve farmland, and ensure steadier energy output[LJ1] [LJ2] . These models are now being replicated across the region. These developments highlight how solar innovation is not just displacing fossil fuels but also optimizing existing energy infrastructure and setting new standards for sustainable development.

Case Study: Indonesia’s Cirata Dam Floating Solar

Indonesia’s Cirata Dam project, inaugurated in late 2023, stands as the largest floating solar installation in Southeast Asia and the third largest globally. Developed through a collaboration between Indonesia’s state utility PLN and UAE-based Masdar, it represents a major source of clean power. This project also serves as a model of international collaboration and a blueprint for future renewable expansion.

Key Details

· Capacity: 192 MWp

· Location: Cirata Reservoir, West Java Province

· Purpose: Supplies clean electricity to ~50,000 homes while supporting Indonesia’s renewable targets

Impact and Future Plans

· Accounts for 25% of Indonesia’s renewable generation at commissioning.

· Expected to avoid 214,000 tons of CO₂ emissions annually.

· Expansion plans include an additional 500 MW, enabled by regulatory changes allowing broader reservoir coverage.

Source: YouTube

Economic Returns: Smart Investment for Better ROI

The financial case for solar is equally compelling. According to a TotalEnergies ENEOS article, businesses across Asia are cutting electricity costs by at least 25% through solar adoption. Long-term Power Purchase Agreements (PPAs) offer price stability, while “zero-CAPEX” models, where providers own, operate, and finance the system, eliminate upfront costs. These arrangements boost profitability, stabilize energy budgets, and align neatly with ESG objectives.

Beyond cost savings, solar is unlocking massive investment opportunities. A 2024 IEEFA report projects that the solar and offshore wind markets, like Japan, South Korea, Malaysia, Taiwan, Vietnam, the Philippines, and Indonesia, could attract over USD 1.1 trillion in investment by 2050. Of that total, USD 394 billion is earmarked for solar PV capacity alone. Another USD 346 billion is expected to stimulate local economies beyond panel manufacturing, through supply chains, infrastructure, logistics, construction, and grid integration. These investments are expected to drive industrial development and significant job creation across Asia.

Taken together, the short-term financial benefits for firms and the long-term supply-chain opportunities for economies show why solar has moved beyond an energy solution and has become a strategic asset.

Strategic Value through Alignment with Sustainability Goals

For businesses, adopting renewable energy like solar extends beyond cost efficiency. It’s a strategic move that strengthens corporate sustainability credentials and delivers measurable advantages:

- ESG Compliance: Demonstrates tangible action on environmental and governance commitments.

- SDG Alignment: Directly supports SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action).

- Certification Readiness: Facilitates green building, carbon neutrality, and ISO energy standards.

- Investor Appeal: Aligns with ESG-focused capital flows and investor expectations.

- Brand Reputation: Positions businesses as sustainability leaders, resonating with customers and stakeholders.

- Regulatory Preparedness: Anticipates and mitigates risks from tightening carbon and energy efficiency regulations.

A Defining Moment for Solar in Asia

Solar energy has evolved from a niche technology into a strategic asset. It delivers measurable environmental benefits, tangible financial savings, and strategic value for businesses seeking to meet rising sustainability standards and stay competitive. With strong policy drivers and technological innovations, Asia is forging a renewable path that balances environmental responsibility with economic performance.

Asia’s leadership in clean energy is not just about scale, it’s about vision. Governments, investors, and businesses that embrace solar today are positioning themselves for long-term success in a rapidly changing global economy. The opportunity is clear, and the time to act is now.

In the race toward sustainable growth, early movers won’t just benefit; they’ll define the future.