Written by Faryal Batool

03 November 2025

ESG strategies have long been treated as a moral or reputational exercise for compliance, but that illusion has collapsed. In 2025, sustainability decisions are deeply entangled with geopolitics, energy security, and economic fragmentation. Global unrest has pushed ESG out of corporate comfort zones and into the arena of real-world power dynamics. What was once a checklist of ethical commitments has become a battlefield of trade restrictions, sanctions, and competing national interests.

ESG is no longer a story of values. It’s a survival strategy in a fractured global economy. The real challenge now is how to pursue sustainability when the world itself is breaking apart.

Rethinking ESG Amid Global Fragmentation

Global instability has rewritten the ESG playbook. Trade wars, resource nationalism, and shifting alliances are forcing companies to treat ESG as an operational priority. According to S&P Global’s 2025 ESG Trends report, the new sustainability agenda is being defined less by emissions pledges and more by supply-chain resilience and trade realignment.

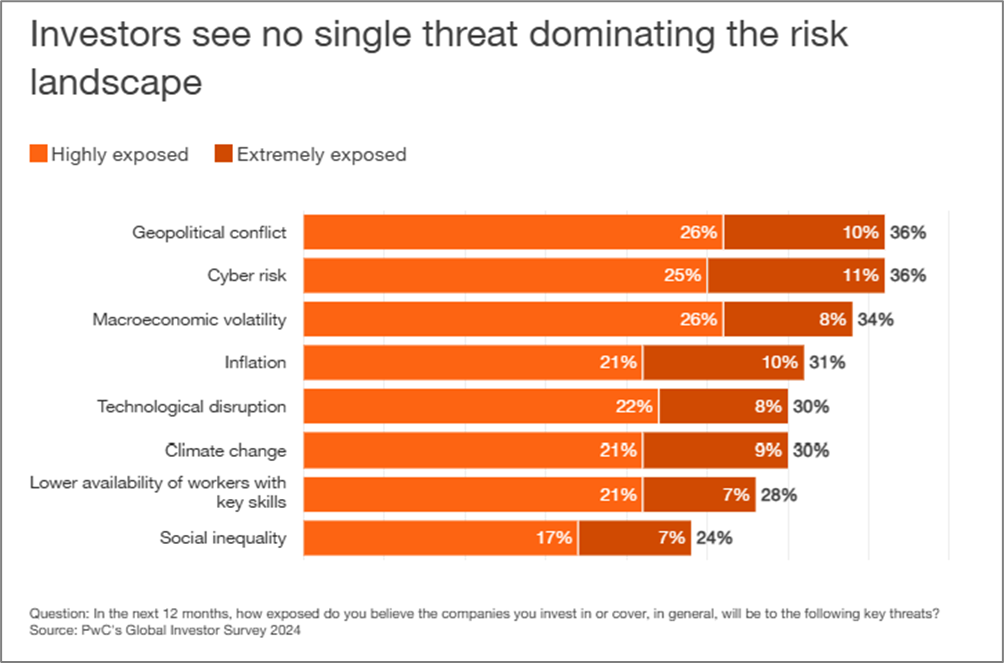

Surveys such as the Verdantix 2025 Global Survey and PwC’s Global Investor Survey 2025 confirm this shift. Executives and investors increasingly view ESG as a hedge against geopolitical and regulatory risk. Sustainability performance is now measured not just by emissions disclosures or ratings but by how well companies govern their supply chains and withstand disruption.

Source: https://www.pwc.com/gx/en/issues/c-suite-insights/global-investor-survey.html

The message is clear: ESG performance is no longer about disclosure quality or carbon pledges but about how effectively a company anticipates and absorbs systemic shocks like sanctions, supply disruptions, resource shortages, and regulatory shifts.

The Energy Transition Hits a Reality Wall

The energy transition is no longer a linear race to net zero; it has become a balancing act between clean ambition, affordability, and energy security. S&P Global’s 2025 ESG Trends report highlights how geopolitical and economic pressures are shifting attention away from decarbonization and toward energy stability and cost control.

Clean investment continues to grow, but rising global power demand, driven by industrial expansion and data infrastructure, is forcing many economies to keep fossil capacity as a safety net. Meanwhile, the International Energy Agency (IEA) warns that without reliable grids and diversified supply chains, renewable progress could stall under the weight of its own volatility.

Success in energy transition depends on treating sustainability, affordability, and security as interconnected goals - not competing priorities.

APAC’s Fragmented ESG Landscape

Asia-Pacific sits at the heart of the global ESG realignment. As both a manufacturing powerhouse and a region highly exposed to climate risk, its response is critical. Yet, regional strategies remain fragmented, shaped by diverse trade dependencies and policy priorities.

- Diverging strategies: China and India have expanded renewables but maintain fossil capacity for energy security. Southeast Asia pursues slower, industry-tied transitions.

- Financing gaps: ADBI and the Asian Development Bank are working to mobilize domestic and private capital for sustainable development. Still, many Asia-Pacific economies face fiscal constraints and rising interest rates that limit green investment.

- Limited coordination: Despite shared climate goals, ASEAN and APEC remain divided on emissions targets and ESG frameworks, deepening regulatory fragmentation across the region.

APAC isn’t a unified ESG market but a mosaic of competing realities. For multinationals, success will hinge on reading policy shifts early and adapting ESG priorities to fragmented, fast-moving local contexts.

ESG Teams Meet Geopolitics

Here’s the reality: ESG can no longer operate in isolation. It has become a geopolitical discipline. To stay ahead, companies should:

- Integrate geopolitics: Assess how trade blocs, sanctions, and resource nationalism reshape ESG risks and embed insights into strategy.

- Stress-test resilience: Evaluate emissions, operations, and continuity under multiple disruption scenarios.

- Diversify sourcing: Spread operations across low-carbon, politically stable regions to reduce risk without overreacting.

- Embed ESG in strategy: Move beyond compliance; leverage reporting insights to drive value and decision-making.

ESG teams must evolve from thinking like reporters to thinking like strategists. Companies that integrate geopolitical foresight and resilience into their sustainability strategies will define the next era of credible ESG leadership.

The End of the ESG Comfort Zone

The global ESG landscape is no longer guided by consensus or moral signalling. It is defined by fragmentation, risk, and adaptation. The intersection of geopolitics, energy security, and trade realignment has transformed sustainability from a reputational choice into a competitive necessity.

The leaders of 2026 and beyond will not be those companies with the thickest ESG reports. They will be the ones who treat ESG as strategic intelligence - integrating risk mapping, capital allocation, and supply-chain resilience into a single, forward-facing system. Boards should not only ask how to comply but also start asking how to compete.