In a surprising turn of events, the European Union’s ambitious Corporate Sustainability Reporting Directive (CSRD) is hitting the brakes. Once hailed as a transformative force for ESG transparency, the CSRD is now facing delays, dilution, and growing investor unease. This article unpacks the latest developments from 2024–2025, explores the implications for companies and stakeholders, and captures how investors are reacting to the shifting regulatory landscape.

🧭 What Is the CSRD?

The CSRD is the EU’s flagship sustainability reporting regulation, replacing the Non-Financial Reporting Directive (NFRD). It significantly expands the scope and depth of ESG disclosures required from companies operating in or with substantial ties to the EU.

Key Features:

- Applies to ~50,000 companies, including large EU firms, listed SMEs, and non-EU companies with significant EU turnover.

- Phased implementation from 2024 to 2029.

- Requires reporting under the European Sustainability Reporting Standards (ESRS).

- Emphasizes “double materiality”—how sustainability affects the company and how the company affects society and the environment.

For a full timeline and scope, see Net0’s CSRD overview and PwC’s Global CSRD Survey 2024.

The Slowdown: What’s Happening?

📉 Legislative Delays and Scope Reductions

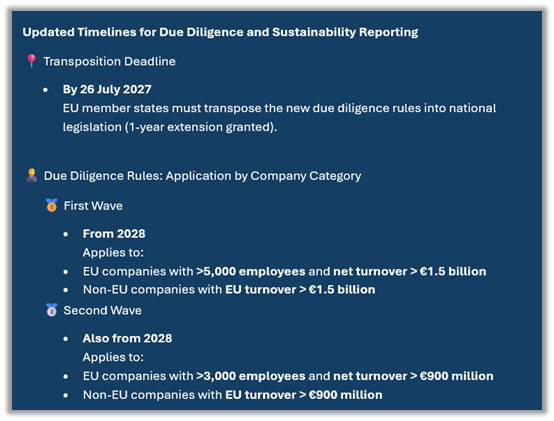

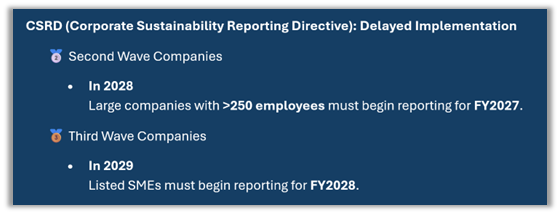

In April 2025, the European Parliament approved a two-year delay for many CSRD obligations, citing administrative burdens and the need for simplification. This move was formalized in the so-called “Stop the Clock” Directive, which:

- Postpones reporting for large companies (the “second wave”) from 2026 to 2028.

- Delays listed SMEs’ reporting from 2027 to 2029.

- Defers sector-specific and non-EU standards to June 2026.

- Reduces the scope of in-scope companies by up to 80% under the proposed Omnibus package.

🇪🇺 Transposition Troubles

As of late 2024, 17 EU member states had failed to transpose the CSRD into national law by the July 6 deadline, prompting infringement proceedings by the European Commission. Political instability in countries like Germany further complicated implementation.

Impact on Companies

1. 🧩 Fragmentation and Confusion

With inconsistent national transpositions and shifting timelines, companies face a patchwork of obligations. Some are forging ahead with full reports, while others are scaling back or pausing preparations.

“We’re seeing a wide range of interpretations and readiness levels. Some reports are 30 pages, others over 300.”

— SESAMm, CSRD Reporting in 2025

2. 💸 Compliance Costs and Uncertainty

Companies cite challenges in:

- Data collection and quality

- Stakeholder engagement

- Double materiality assessments

- Assurance readiness

Despite this, many still see long-term value in CSRD compliance, including improved risk management and stakeholder trust.

📉 Investor Reactions: From Hope to Hesitation

📈 Initial Optimism

Investors initially welcomed CSRD as a game-changer for ESG transparency. A 2024 PwC survey found that 70% of investors supported integrating sustainability into corporate strategy.

Growing Concerns

But the recent delays and dilution have sparked concern:

- “It complicates comparability. Investors are now drowning in a mix of voluntary and limited disclosures.”

— Sondre Myge, Head of ESG, Skagen Funds - “If double materiality is scrapped, CSRD loses its edge. We need robust, comparable data to allocate capital effectively.”

— Institutional Investors Group on Climate Change (IIGCC), IR Impact

🧠 Strategic Repositioning

Some investors are recalibrating expectations, focusing on:

- Voluntary disclosures from leading firms

- Sector-specific ESG benchmarks

- Engagement with companies on materiality and data quality

🔮 What’s Next?

For Companies:

- Stay the course: Early reporters are gaining reputational and strategic advantages.

- Focus on materiality: Even if scope narrows, stakeholder expectations remain high.

- Prepare for assurance: Limited assurance is still required for many in-scope entities.

For Investors:

- Push for consistency: Advocate for harmonized implementation across member states.

- Demand quality: Engage with companies on data integrity and comparability.

- Think beyond compliance: Use CSRD as a lens for long-term value creation.

🧩 Final Thoughts

The CSRD slowdown is not a retreat from sustainability—but a recalibration. While delays may ease short-term burdens, they also risk undermining the EU’s leadership in ESG transparency. For companies and investors alike, the message is clear: the sustainability journey continues, but the road just got more winding.

🔗 Join the ESG Business Institute

🔗 References

- EU Parliament Votes To Delay Implementation of Sustainability Reporting – Skadden

- CSRD and CSDDD Officially Delayed – National Law Review

- Council Adopts Directive to Delay Reporting Obligations – Consilium

- CSRD Explained: 2025 Guide – Leafr

- Three Months On From the CSRD Transposition Deadline – JD Supra

- Implications of the Delay to the CSRD Implementation Law – Taylor Wessing

- Global CSRD Survey 2024 – PwC

- CSRD Reporting in 2025 – SESAMm

- A Pared-Back CSRD Might Sound Good, But ESG-Minded Investors Won’t Be Happy – IR Impact