As venture capital investments hit record heights with each year in the United States — topping $330 billion in 2021 — most of that funding continues to go to companies led by white men, a disparity that exacerbates the country’s racial and gender wealth gaps. These gaps have continued to grow in recent decades, with long-term implications: the average Black or Hispanic household brings in about half as much in earnings each year as the average white household, and Black and Hispanic households have 15% to 20% as much net wealth, according to the Federal Reserve. The numbers are even more stark for women of color, who have far lower incomes and savings amounts for a variety of reasons.

As venture capital investments hit record heights with each year in the United States — topping $330 billion in 2021 — most of that funding continues to go to companies led by white men, a disparity that exacerbates the country’s racial and gender wealth gaps. These gaps have continued to grow in recent decades, with long-term implications: the average Black or Hispanic household brings in about half as much in earnings each year as the average white household, and Black and Hispanic households have 15% to 20% as much net wealth, according to the Federal Reserve. The numbers are even more stark for women of color, who have far lower incomes and savings amounts for a variety of reasons.

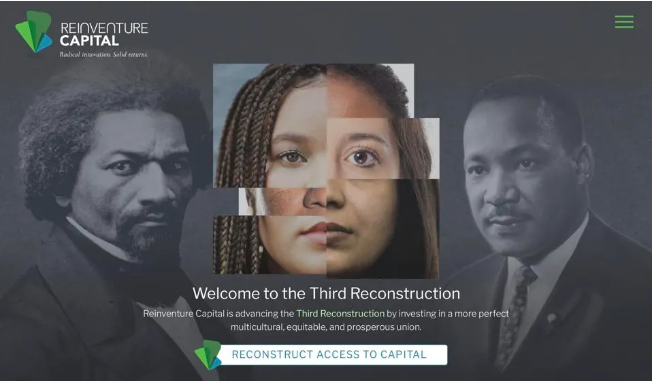

Especially in recent years, more people in the financial industry are realizing the need to use their influence — and their funding — to address these gaps. Reinventure Capital is among the financial firms leading by example and applying a racial and gender equity lens to its investments. The firm was founded in 2014 by Edward Dugger III, a pioneer in the impact investing field who continues to push for bigger and broader changes and driving funding toward overlooked and underfunded entrepreneurs.

Julianne Zimmerman, Managing Director at Reinventure Capital, says the firm invests with a goal of creating opportunities for and advancing the innovations of women and People of Color — and a broader view of shifting the VC system toward greater equity and inclusion. “What that comes down to is who has authority, who has a say, who has control, who has ownership,” she says. “When you look at the distribution of capital, consistently more than 90% of venture capital goes to an extremely narrow demographic — in broad strokes, straight, white, U.S.-born men from a dozen universities.”

That concentration of capital lands primarily in a half-dozen metropolitan areas, she says, further exacerbating inequities. “It also means that we have this perilously unbalanced means of propagating ideas and value propositions and technologies and services,” Zimmerman says. “They’re only coming from and validated by and, for the most part, serving that same demographic. That has all manner of ramifications: social, environmental, health, but also economic.”While Zimmerman acknowledges that Reinventure Capital’s work represents a small portion of the overall VC market, she says their work is designed to inspire more investors to also realize the importance of acting to avoid those ramifications on people and the planet. She shared more about Reinventure Capital’s strategy and vision with me during a recent conversation as part of my research on purpose-driven business. This interview has been lightly edited for length and clarity.

As part of our investment terms, we have binding commitments that the companies we invest in will continue to hire, promote, and compensate equitably as they grow; and furthermore will source equitably to the extent that’s feasible, because we recognize that it’s not always in every instance. We also have binding terms in our investment documents that commit us and our portfolio companies to their strategic impact objectives. We differentiate those strategic impact objectives from broader impact initiatives, which we also applaud and encourage: we define strategic impact as that which is integral to the business model, such that pursuing the impact advances the business, and building the business expands the impact.

It’s important enough to us to put that in the investment documents, because we know from experience that over time it’s possible to lose sight of that connection and therefore to wander off course. So we’re carrying that discipline forward from my senior partner Ed Dugger’s prior investment practices.

We also know from that prior experience that this is a high-return investment strategy, as Ed’s most recent prior fund delivered a 32% internal rate of return, which was top tier performance for its vintage. He did this by generating what we call a majority wins profile, which is really the inverse of the prevailing venture model of one or two portfolio companies returning the fund and the rest essentially being written off. In Ed’s former fund, two-thirds of the companies in the portfolio contributed to the return; of the third that didn’t, about half returned capital. So, only about a sixth of the fund was written off. Again, we’re carrying forward that discipline.

We’re about halfway through investing our current fund and are not currently raising. We have several institutional limited partners (LPs) of note, such as MassMutual, Bank of America, and the like, but we also have several first-time LPs — individuals, family offices, small endowments, and foundations that don't have large venture portfolios. That's also by design, because we want to engage a broader community of aligned investors, both in advancing the investment strategy and the impact it offers, and in reaping the rewards of that investment strategy and impact.

Marquis: How is this approach to financial services and venture capital designed to help advance systems change? What are some of the motivations for directly addressing the inequity of VC funding in female and BIPOC founders?

Zimmerman: This is the first fund under the Reinventure banner, for this team working together. It’s difficult for me to disambiguate between the purpose, resolving the gross inequities of the venture community as it is, and the opportunity. Both are equally motivating to me but they're also so inextricably intertwined that it's impossible for me to say, “This is the part that's about fixing or replacing or upgrading the existing system,” and “This is the part that's about what's possible.” For me they are one and the same.

When you look at the distribution of capital here in the States, consistently more than 90% of venture capital goes to an extremely narrow demographic — in broad strokes, straight, white, U.S.-born men from a dozen universities. That’s a very steep set of filters, and the majority of that capital lands in a half dozen metropolitan areas. So first of all, that is an extreme hyperconcentration of resources no matter how you look at it, which is problematic all by itself.

It also means that we have this perilously unbalanced means of propagating ideas and value propositions and technologies and services. They’re almost exclusively coming from and validated by and, for the most part, serving that same demographic. So that has all manner of ramifications: social, environmental, health, and of course economic.

It’s also a failure to appropriately price opportunity and risk — the very definition of a market dislocation — in light of findings by BCG, Morgan Stanley, and others that heterogeneous teams led by women and People of Color tend to outperform largely homogeneous teams led by white males. I’m sure you have seen reports from McKinsey and others, for example, that say, by the way, social justice concerns aside, this dislocation generates a $4 trillion dollar loss to investors, and a $16 trillion hit to the U.S. economy.

So the hyperconcentration of venture capital (and other financial resources) is not an obscure or abstract ethical consideration, it shapes our social fabric, and it’s definitely a material financial concern. It’s a causal driver, in fact, of some of the most serious issues we're experiencing.

When you look at that big picture as a set of potentially remediable issues, we as a small fund are not going to remediate that set entirely. We have lofty aspirations, but they’re not that lofty.

Fortunately we at Reivnenture are also far from alone in questioning the way in which the venture community looks at what constitutes value and what constitutes a win. And we look at Georges Doriot’s original model when he created this thing called venture capital, which was to invest in nascent companies with the potential to become economic engines, to be real creators of value for the communities in which they operate, for the economy at large. From our point of view, that really argues in favor of profitable enterprises, self-sustaining companies that are not dependent on logarithmic infusions of outside capital. Moreover, we look at the issues associated with the extremely steep asymmetries in wealth and opportunity driven by the deep divide in access to capital, and so we select for opportunities to create and advance innovations with relevance for women and People of Color.

What that comes down to is who has authority, who has a say, who has control, who has ownership. So we work really hard with our founder teams to retain ownership on the cap table as much as possible, and to infuse that ownership as deeply as possible in the employee base. One of the ways we do that is by helping them as profitable enterprises to access lower cost of capital — commercial debt — than pursuing subsequent equity raises. The funny thing is that you would think that was just sort of sensible. But it’s astonishing how often we encounter people, particularly peers in the venture sector, who think that sounds terrifyingly risky and difficult.

Marquis: Why do you think that is?

Zimmerman: It’s important to acknowledge that bias — both conscious and unconscious — is real and evident in the venture community, as elsewhere across our society.

At the same time It also think it’s partly just the human psychology propensity to see something that's different as inherently more difficult or more risky. When you have vast sums of capital more or less following a narrowly trodden path, and someone is even just a few steps to either side of that path, it can seem alarmingly divergent, even threatening. Again, that’s just human psychology.

Marquis: I’d love to hear more about what you do with the companies. I didn’t realize that two-thirds of the investments are contributing to the return, and many others were at least break even, which is so different than other VC portfolios. What are you doing to make that happen?

Zimmerman: Fundamentally, I think it’s a difference in targeting coordinates. If your expectation going in is that one in 10 of your portfolio companies will have a headline-making exit and the rest will fall by the wayside, you’re going to think and utilize resources accordingly with that expectation. Again, this is just basic human psychology.

The rationale or operating principle of the majority of the venture community is focused on the next raise, the next round, increasing the valuation for that next markup, as opposed to strengthening the mechanism of the enterprise. In many instances we hear and engage in conversations with our venture peers who will say things like, “If you’re turning a profit, you’re not growing fast enough,” or “Don’t get distracted worrying about impact — it’s hard enough to grow a business. If you want to have impact, have a big exit and then give some money away.” It’s just a fundamental difference in priorities and objectives, and the expectation of a majority failure model that’s even in many instances celebrated as a feature rather than a bug.

Our priorities, our objectives, our operating principles are quite different. We’re looking at companies that are commercializing solutions at the forefront of currently unfolding shifts in fragmented industries, and they’re doing that with a profitable business model. And they are intentionally growing the kinds of heterogeneous teams that our experience and all the organizational literature tell us are more effective at retaining their innovative, creative capacity as they grow. Those companies are not only intrinsically advantaged to grow organically relative to their competitors and to create real value for their customers in the process, but they are also extremely attractive acquisition targets.

We don’t expect to necessarily direct any of our companies to a particular acquisition versus public offering or even a structured exit. Instead the way that we think about their growth automatically bakes in some relatively straightforward exit, at a minimum. The sort of threshold case for us is a company that may raise a total of, let’s say, $30M in equity capital, and for which we believe there is strong acquisition appetite. Depending on the industry or market segment, the belly of M&A — the boring, every day transactions — ranges around $500M, plus or minus a couple hundred million dollars. So if that company finds a very mundane exit to an acquirer, it still delivers a sound multiple to us as investors and a solid financial outcome for the founders and employees. That's not the aspiration we’re aiming for with any of our portfolio companies, but it’s a respectable threshold for success. The point is that the intrinsic value of the company is such that even if they don't do fantastically well, they should still have a good outcome for all involved.

Going back to our investment philosophy, we’re structuring our investments for a majority of wins rather than a majority of losses, and so that everyone wins when there’s a win. We have a different set of objectives, a different set of priorities, a different set of principles, and so we make decisions accordingly.

Marquis: Are there any examples of companies that you work with you can share?

Zimmerman: We have six companies in the portfolio right now, and the first company we invested in in this portfolio is Canela Media. It's a New York-based company led by Isabel Rafferty Zavala, a Latina founder and CEO who is very experienced in the media sectors. Canela is her third launch. She has assembled a stellar team around her, primarily Latinx and primarily female. They went from a standing start to number three in Hispanic audience reach in just over two years. They are growing quickly in the U.S. and expanding across Latin America.

When we initially looked at that company we asked several very knowledgeable experts in the media sectors for their opinions, and to a person every single one of them told us this is a saturated audience, the media sector is flooded with capital, and there’s really no room for anything more than a niche play in the gaps too small for the giants to contest.

But what we heard when we talked to Candela Media customers and partners was, in sharp contrast, that the Hispanic / Latinx / Spanish-dual-language audience is the most culturally diverse “minority group” in the United States and the largest population in the Americas. And that audience is served very poorly and very narrowly by predominantly one cultural frame of reference, and a pretty thin representation at that. There was real unsatisfied hunger for more authentic, more representative content and access to media. Then there is the fact that here in the U.S., that is also the fastest-growing demographic under 25. If you are a customer-serving enterprise of any kind, you have to be paying attention to that rising customer base. Listening to this unsatisfied audience and paying attention to the unsatisfied commercial opportunity told us that there was more than niche potential. There was an unmet, unfulfilled need that was poorly perceived by the incumbents and by the established industry leaders, but well understood by a founder and team with the insight and skill to serve that market well. Isabel and the Canela Media team are executing on that insight and skill brilliantly.

Marquis: You recently wrote about the issue of externalities as an example of the need for systemic change. How does the issue of externalities connect with your firm’s work on venture capital?

Zimmerman: The canard of externalities has always seemed to me to be intrinsically obvious. From the first time I heard someone refer to externalities, it has consistently struck me as, “Oh well, there's just all this stuff that we don't want to talk about, so we’re just going to say that it's irrelevant.” So it wasn't so much that something in particular prompted me to write about this topic, it just sort of bubbled to the surface as one of many themes that are sort of swirling around in my own internal echo chamber over the past many years. I hope that the concept of externalities is also starting to become maybe a little bit tarnished in the minds of a wider audience.

I don't think [the concept of externalities] is yet fully considered disreputable; I think it's still widely accepted as a kind of given. But I am starting to hear from other people, other conversations, Maybe this isn’t really the best way to think about our investment. Maybe this isn’t really the best way to think about our economy. Maybe this isn’t really the best way to think about our wealth or our assets. I hope to play an instigator role in amplifying and expanding those conversations. I am hoping that there’s enough receptivity to those questions that putting out this provocative little blog post might actually encourage some people who read it to examine their own exposure to externalities and even take action to upgrade their investment criteria and practices.

Marquis: Can you speak a bit more about the labor, marginalized populations aspect?

Zimmerman: Some of the companies we have looked at and are looking at now are specifically addressing issues associated with supply chains and labor and access to talent and related fault lines around people — whether professionals or blue-collar workers — as human beings and as contributors to the economy. We probably will end up investing in one or more of those again.

But our broader point of view is really again that the way capital flows particularly in the U.S., for good or ill, the rest of the world sort of follows along — and, in this case, I would say that’s arguably for ill. In the U.S., we are sidelining and pushing aside the majority of talent. That has severe social repercussions, health and environment repercussions, security repercussions, human rights repercussions, particularly when we're talking about AI and Web3, and the way other new technologies are being developed. This should not be news to anybody. We've seen the same thing in the healthcare sector where over-reliance on a very narrow set of patient models has consistently resulted in severe and, in many cases, unnecessarily harrowing and fatal repercussions. We also know that we're missing out on a lot of other innovation, a lot of other commercial opportunities. For us, focusing on those overlooked and discounted founder teams and their businesses is one way to counter that. Also, making sure that those founder teams and their stakeholders are able to secure a fair share of the value they create, we can begin to shift that inappropriate and destructive dynamic.

When we think about labor specifically, we're really keen to see that each company we invest in is hiring, promoting, compensating equitably from top to bottom. It’s not OK, for example, if a company has most of its female and Black and Brown employees as hourly workers, and most of its white, male employees as white collar salaried employees. It’s also not OK with us if a company's business model is based on driving labor costs to zero. It’s legal, and in many quarters of the financial markets it’s celebrated, but it’s not OK. Because if you’re driving labor costs to zero you’re basically just displacing the cost of operating your enterprise onto somebody else. Onto those workers, their communities, the government, social agencies, and on and on. We work closely with the companies we invest in to make sure that they are operating equitably internally, and not exporting externalities through their employees and operating practices.

Marquis: How you are working within the investment ecosystem to encourage new thinking about investment criteria and social impact?

Zimmerman: We participate with many other public market-focused players — Adasina, Boston Common, Nia Impact Capital, Trillium, and Zevin, for example — as well as in working groups like Racial Justice Investing, GenderSmart Investing, IDiF, WISE, BASIC, and other peer communities of practice.

On the venture side, we only co-invest alongside aligned investors. We never want to own an investment outright, since we don’t think that’s in anybody’s best interest. We also actively seek not only to cultivate aligned syndicates with peers and allies but also to promote the work of other peers and allies pursuing adjacent or altogether separate investment strategies, because there’s no such thing as one right answer or one size fits all. We try to do whatever we can to raise people's awareness that these strategies exist alongside ours. We see this fantastically vibrant and varied community that offers the same founders and LPs we are focused on a growing set of options and resources.

Unfortunately, taken together, funds managed by Reinventure and all of our aligned peers collectively add up to a tiny fraction of the venture community writ large. There is at least a two-order-of-magnitude gap between the opportunity set available right now and the capital allocated to address that opportunity, not to mention that the opportunity pool only continues to proliferate.

That’s why the biggest thing I have optimism around right now is bringing new LPs to the field. What gives me a little bit of encouragement is how often I hear from the wealth advisor community, the inheriting generation, successful founders and professionals, alumni and donors, and even retail investors that as people examine the system around them, they are increasingly saying the old model just doesn't cut it. They want more thoughtful, informed, sustainable, ethical, mindful investments. They want to be able to invest in the kind of world we want our children to live in.

My motivation in writing and speaking on these topics is to embolden more people to take that step of moving money — whether their own or capital they bear responsibility for managing — to better instruments and upgrade to higher expectations, no matter what asset class they occupy. There is no shortage of excellent strategies, instruments, fund managers, or companies. There are also brilliant programs offered by the Impact Finance Center, among others, to assist institutional entities to make the shift. And there are numerous communities of practice for investors of all stripes, capital capacities, and return objectives. We list a very small sampling of resources on our website, as a leg up to anyone interested in starting their exploration.

As one particularly long capital lever, it would be fantastic if we could liberate a meaningful portion of donor advised fund (DAF) monies for impact investing, which after all was their original purpose. I’ve had too many conversations with very sophisticated DAF account funders who don’t even realize they have that power because the platform hosting their account only offers them very limited disbursement options, primarily or even exclusively philanthropic. Here’s the great thing: if you have a DAF account and your host platform doesn’t offer you impact investing options, you can move to one that does. There are several excellent options to choose from. It only takes a tiny bit of initiative.

On a policy basis, it would be transformative if foundations and nonprofits — educational institutions and religious congregations included — were required in order to maintain their nonprofit status to have their investment holdings (the corpus) conform to their stated mission, their organizational charter. That would change everything. Here’s the thing: alert institutions don’t actually need a new law, regulation, or guidance to recognize that upgrading their investment practices to align with and advance their mission would not only better serve their constituents socially, environmentally, economically, and otherwise, but better serve the endowment financially as well. That is the very definition of fiduciary duty after all, and the supporting evidence is all readily available in plain sight. Trustees and endowment investment committees just need to take courage and act to true up their practices and policies to the facts in front of them. Members of those communities can help by speaking up and urging — or, if necessary, demanding — that recalibration.

System change is a huge task, and can seem hopelessly overwhelming. But I am daily inspired to celebrate and uplift the founders who are building better, more inclusive, more innovative, more resilient and sustainable companies; to amplify the great work of peers and colleagues at the forefront of upgrading the finance sector to better and more responsibly serve all of its constituents; and to point out that system change is not only theoretically possible and desperately overdue but readily achievable. For those of us with fiduciary duty, it’s our professional obligation. Moreover, it’s in all of our respective narrow individual or organizational self-interests to make it happen on our watch, so we can take part in celebrating success and enjoying the benefits. For these and many more reasons I am motivated to do whatever I can to get as many people as possible off the sidelines and engaged in participating in driving change across venture and the rest of the financial sectors with all the resources at their disposal.