Voluntary Carbon Markets (VCMs) are undergoing one of their most transformative periods yet. After years of rapid but uneven growth, global stakeholders are now prioritizing integrity, transparency, and robust verification while unlocking new innovations in measurement, reporting, and crediting. As these improvements accelerate, ASEAN countries are increasingly positioned to become leaders in supplying high-quality carbon credits, especially nature-based ones.

Market Growth and the Rise of Integrity Frameworks

Demand for carbon credit has grown steadily, with corporates using VCMs to complement decarbonization strategies. However, concerns about credit quality, “phantom emissions reductions,” and ambiguous methodologies triggered a major credibility challenge.

This led to the creation of integrity bodies like the Integrity Council for the Voluntary Carbon Market (ICVCM). Its Core Carbon Principles (CCPs) set new benchmarks for quality covering additionality, robust quantification, permanence, and sustainable development impacts. ICVCM now evaluates crediting programs and methodologies against these criteria, aiming to ensure that only truly highintegrity credits are labeled CCP-Eligible.

Source: https://icvcm.org/core-carbon-principles/

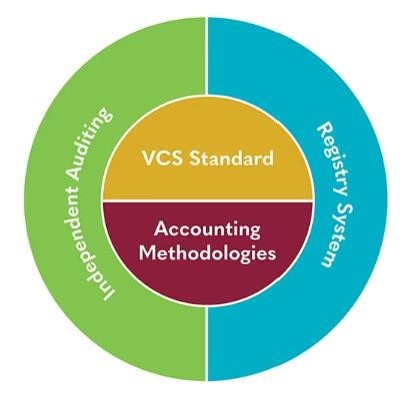

| Parallel to this, Verra strengthened its Verified Carbon Standard (VCS) by updating methodologies, enhancing project monitoring requirements, and improving its validation–verification process. Verra's reforms specifically address concerns highlighted in third-party investigations, reinforcing its stance as the world’s most widely used carbon crediting program. |  |

These steps align with the UN’s State of Finance for Nature report, which emphasizes that highintegrity carbon markets can mobilize billions into nature-positive solutions if verification standards remain rigorous.

Technology-Driven Innovations Strengthening Credibility

A major shift in VCMs is the rapid adoption of MRV technologies including AI-based monitoring, remote sensing, digital MRV systems, satellite tools, and blockchain.

A key driver of this evolution is the World Bank’s Carbon Action Transaction Services (CATS)platform, which is designed to help countries and project developers manage carbon crediting activities more effectively. CATS provides digital tools that support end-to-end crediting covering registry services, authorization processes, reporting tools, and transaction tracking. Importantly, it helps countries operate carbon market mechanisms under Article 6, strengthening integrity and consistency across national and voluntary markets.

This complements World Bank digital MRV guidance, which underscores how automated data collection and digital verification systems can speed up project implementation, reduce transaction costs, and enhance transparency in reporting.

Similarly, the UNDP Carbon Market Simulation Toolshows how digital protocols help climate project developers test methodologies, streamline reporting, and identify gaps before validation.

Meanwhile, Bain & Company’s analysis on climate technologies identifies advanced sequestration measurement toolssuch as LIDAR-based biomass assessments and MRV-integrated soil carbon sensors as driving the future of verifiable, real-time monitoring. These technologies are essential for ensuring permanence and quantifiable results in land-based mitigation.

Collectively, these innovations reduce reliance on estimates and increase investor confidence by making emissions reductions measurable, traceable, and independently verifiable.

Nature-Based Solutions: ASEAN’s Strategic Advantage

ASEAN countries possess some of the world’s richest ecosystems: mangroves, tropical forests, peatlands, and seagrass beds, making the region highly competitive in generating nature-based carbon credits (NBS).

The UNDP Indonesia – Natural Capital Prospects report emphasizes the country’s high potential for forest conservation, mangrove restoration, and reforestation investments. Indonesia is home to over 20% of the world’s mangroves, which offer some of the highest carbon sequestration potential globally.

Malaysia, Thailand, and Vietnam also exhibit strong opportunities in blue carbon, agroforestry, and community-based conservation. The region’s ecosystems align well with the UNEP State of Finance for Nature projection that nature-based solutions must triple in investment by 2030 to remain on a Paris-aligned path.

In addition, monitoring improvements such as those recommended in the World Bank’s carbon market guidance enable ASEAN developers to overcome past barriers related to data quality, leakage proofing, and baseline validation.

Toward Investor Confidence and ESG-Linked Carbon Strategies

As VCM standards strengthen, companies are integrating carbon credits into broader ESG and decarbonization strategies not as offsets alone, but as part of a value-driven transition approach.

Deloitte’s analysis of carbon markets highlights how corporates increasingly rely on high-integrity credits to complement (not replace) science-based internal reductions, ensuring alignment with climate commitments.

PwCreports that VCMs provide pathways for companies in hard-to-abate sectors to fund climate mitigation beyond their value chain, especially in regions where the cost of emissions reductions is significantly higher.

KPMG’s Nature & Biodiversity insights emphasize that investors are building frameworks where carbon, biodiversity, and community co-benefits strengthen long-term climate adaptation and mitigation.

This is especially relevant in ASEAN, where projects often involve local communities and indigenous groups.

Such integrated ESG-carbon strategies rely on credits that meet high-integrity criteria making ICVCM, Verra, and digital MRV technologies essential.

Conclusion: ASEAN’s Opportunity to Lead

High-integrity, tech-enabled, and transparent carbon markets are now the backbone of a credible VCM ecosystem. As global standards rise, ASEAN’s ecological assets, coupled with increasing investment in monitoring systems and policy development, position the region as a future hub for premium, nature-based carbon credits.

With strong governance, continued innovation, and alignment with global integrity frameworks, ASEAN can play a central role in the world’s transition to a net-zero, nature-positive economy