Introduction: Why Scope Literacy Matters in 2025

In 2025, ESG reporting has moved from “voluntary best practice” to regulatory expectation. Investors, regulators, and communities now demand clarity on how organizations measure and disclose their greenhouse gas (GHG) emissions. Yet, confusion persists around the three “scopes” defined by the Greenhouse Gas Protocol.

Scope literacy is no longer optional, it is the foundation of credible ESG reporting. Without it, companies risk greenwashing accusations, regulatory penalties, and reputational damage. With it, they gain investor confidence, operational efficiency, and a pathway to net zero.

Scope Definitions: Clear, Visual, and Practical

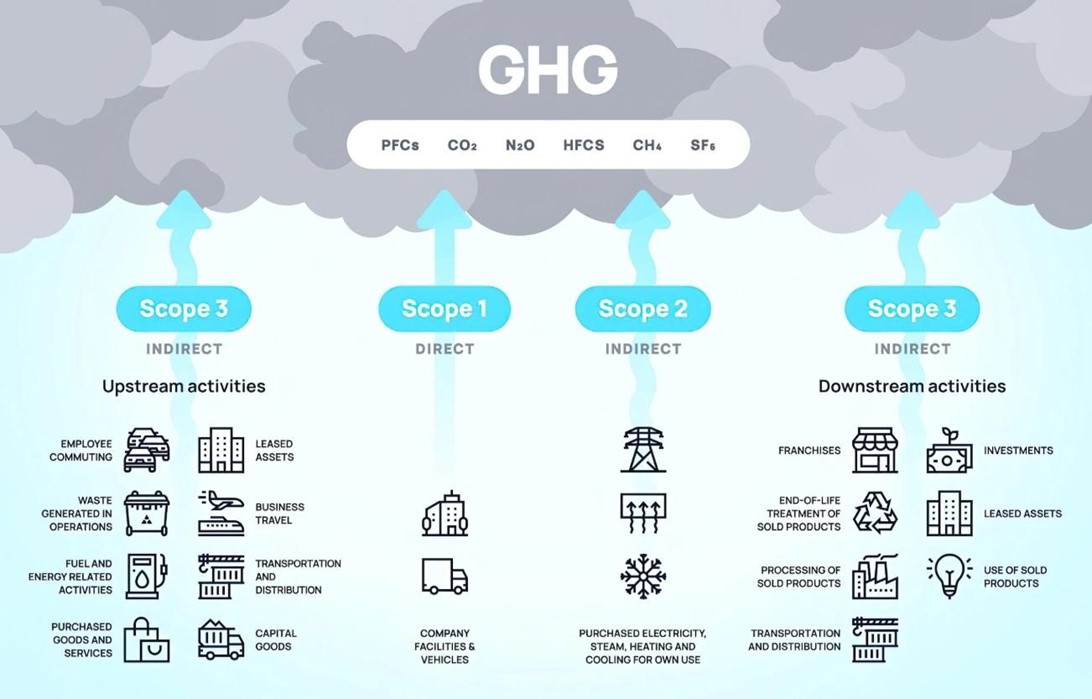

The Greenhouse Gas Protocol classifies emissions into three scopes:

- Scope 1 (Direct emissions): From owned or controlled sources, e.g., fuel combustion in company vehicles or boilers.

- Scope 2 (Indirect emissions from energy): From purchased electricity, steam, heat, and cooling.

- Scope 3 (Value chain emissions): All other indirect emissions that occur in a company’s value chain, upstream and downstream.

15 categories include: purchased goods and services, capital goods, fuel- and energy- related activities (not included in scope 1 or scope 2), upstream transportation & distribution, waste generated in operations, business travel, employee commuting, upstream leased assets, downstream transportation & distribution, processing of sold products, use of sold products, end-of-life treatment of sold products, downstream leased assets, franchises, and investments.

Source: YouTube (from Sustain Life)

Scope 1, 2 & 3 Infographic (Credit: GHG Protocol)

Think of it as concentric circles: Scope 1 is your immediate footprint, Scope 2 is your energy dependency, and Scope 3 is the ripple effect across your ecosystem.

2025 Regulatory Landscape

The regulatory push is intensifying:

- Malaysia’s National Sustainability Reporting Framework (NSRF): Scope 1 & 2 disclosures required by 2026, Scope 3 by 2027.

- Singapore Exchange (SGX): Climate-related disclosures mandatory for listed firms, aligned with ISSB standards.

- Global: ISSB’s IFRS S1 and S2 standards now in effect, harmonizing ESG reporting worldwide.

This means companies in ASEAN must prepare for audit-ready Scope disclosures within the next two years.

Scope 3: The Frontier of ESG Complexity

Scope 3 often accounts for 70–90% of a company’s total emissions, yet it is the hardest to measure. Challenges include:

- Data gaps: Suppliers may lack reporting capacity.

- Double-counting risks: Emissions can overlap across value chains.

- Category complexity: 15 categories ranging from purchased goods to product endof-life.

Case in point: A regional logistics firm in ASEAN discovered that employee commuting and outsourced transport contributed more emissions than its own fleet. Scope 3 revealed the hidden hotspots.

Tools and Methodologies for Scope Calculation

Companies are turning to:

- GHG Protocol tools: Standardized emission factors and boundary-setting guidance.

- AI-powered platforms: Automating supplier data collection and filling gaps.

- Blockchain solutions: Ensuring traceability across supply chains.

- Sector-specific models: Tailored emission factors for industries like manufacturing, agriculture, and logistics.

These tools help organizations move from estimates to evidence, strengthening credibility.

Reporting Tips for ASEAN Companies

- Start with Scope 1 & 2: Build confidence in direct and energy-related emissions.

- Map Scope 3 categories: Prioritize high-impact areas like purchased goods and transport.

- Engage suppliers early: Capacity building is key to reliable data.

- Document assumptions: Transparency builds trust with auditors and stakeholders.

- Align with ISSB & GHG Protocol: Ensure global comparability and audit readiness.

Conclusion: From Awareness to Action

Scope literacy is the gateway to credible ESG reporting. In 2025, companies that master Scope 1, 2, and 3 disclosures will not only meet regulatory requirements but also gain competitive advantage.

The message is simple: do not wait for deadlines—start mapping, measuring, and reporting now. ESG BI will continue to spotlight tools, case studies, and innovations to help organizations move from awareness to action.